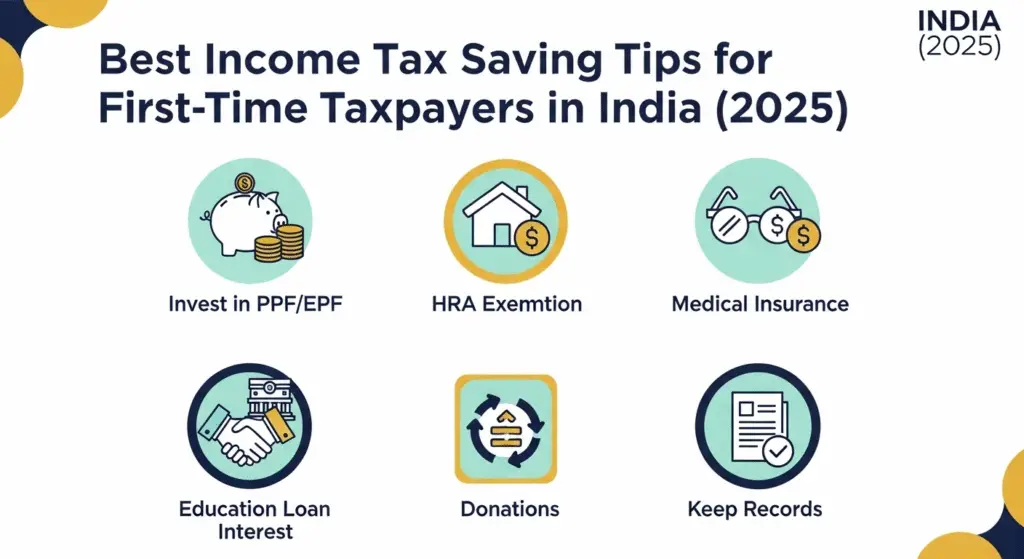

Paying income tax for the first time can feel overwhelming, especially when you’re just starting your career or business. But here’s the good news: the Indian government provides several legal ways to reduce your tax liability and save more of your hard-earned money.

In this guide, we’ll explain the best income tax saving tips for first-time taxpayers in India — in simple, clear language — so you can make smart financial decisions and avoid overpaying taxes.

💼 Who Is Considered a First-Time Taxpayer?

If you’re:

- Earning a salary for the first time,

- Running a new business or freelancing,

- Or earning income above the basic exemption limit (₹2.5 lakh for FY 2024-25 under old regime),

…then you’re likely required to file an Income Tax Return (ITR).

💡 1. Choose the Right Tax Regime

As of 2025, India offers two tax regimes:

A. Old Tax Regime

- Comes with various deductions and exemptions like 80C, HRA, etc.

- Better for people who make tax-saving investments.

B. New Tax Regime (Default)

- Lower tax slabs but no major deductions allowed.

- Best for those with fewer investments or deductions.

👉 Tip: Use online tax calculators to compare both and choose what suits your financial habits.

💰 2. Invest Under Section 80C (Up to ₹1.5 Lakh Deduction)

Section 80C is the most popular way to reduce your taxable income.

You can claim a deduction up to ₹1.5 lakh per year by investing in:

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- Equity Linked Saving Scheme (ELSS)

- 5-Year Tax-Saving Fixed Deposits

- National Savings Certificate (NSC)

- Life Insurance Premiums

- Sukanya Samriddhi Yojana (for girl child)

- Principal repayment on home loans

- Children’s tuition fees

👉 Example: If your income is ₹6,00,000 and you invest ₹1.5 lakh under 80C, your taxable income becomes ₹4.5 lakh.

🏥 3. Claim Health Insurance Premiums – Section 80D

You can save tax by buying health insurance for yourself and your family.

- Self/spouse/children: Up to ₹25,000

- Parents (senior citizens): Up to ₹50,000

- Total possible deduction: ₹75,000 per year

Even preventive health check-ups (within ₹5,000 limit) are covered.

🧓 4. Contribute to National Pension System (NPS) – Section 80CCD(1B)

Investing in NPS gives you an additional ₹50,000 deduction, over and above the ₹1.5 lakh limit under 80C.

This means:

- 80C = ₹1.5 lakh

- 80CCD(1B) = ₹50,000

- Total = ₹2 lakh tax deduction

NPS is ideal for building retirement wealth while reducing taxes.

🏠 5. Use Home Loan Benefits – Section 24(b)

If you have taken a home loan, you can claim:

- Interest paid on home loan: Up to ₹2 lakh under Section 24(b)

- Principal repayment: Covered under 80C (within ₹1.5 lakh limit)

Bonus: You also get stamp duty and registration fee deduction under 80C.

🎓 6. Deduction on Education Loan Interest – Section 80E

If you’re paying an education loan for yourself or your dependents:

- Entire interest paid is deductible

- No upper limit

- Available for up to 8 years

Great for students or young professionals repaying student loans.

🪙 7. Claim House Rent Allowance (HRA) If Living in Rented House

If you’re a salaried employee living in a rented house, you can claim HRA exemption under Section 10(13A).

To claim:

- You must receive HRA from your employer

- You must actually pay rent and keep rent receipts

No HRA in the new regime.

🧾 8. File Your Income Tax Return (ITR) on Time

Even if your income is below the taxable limit, it’s a good habit to file your ITR:

- Helps you claim refunds (like TDS deducted)

- Required for visa, loan, and credit card applications

- Helps build your financial credibility

👉 Due date for ITR filing (FY 2024-25) is 31st July 2025.

👨💻 9. Track TDS and Form 26AS

Sometimes your employer or bank deducts TDS (Tax Deducted at Source).

You can:

- Check your Form 26AS on the Income Tax portal

- Match TDS with your Form 16 or bank FD interest

- Claim refunds if extra TDS was deducted

👮♂️ 10. Avoid Cash Income & Keep Digital Records

To stay safe from scrutiny:

- Avoid large cash transactions

- Keep digital records of all tax-saving investments

- Link PAN with Aadhaar

- File returns honestly to avoid penalties

📝 Summary Table: Top Tax-Saving Options

| Section | Investment Type | Max Deduction |

|---|---|---|

| 80C | ELSS, PPF, FD, LIC, etc. | ₹1.5 lakh |

| 80CCD(1B) | NPS contribution | ₹50,000 |

| 80D | Health insurance | ₹75,000 |

| 24(b) | Home loan interest | ₹2 lakh |

| 80E | Education loan interest | No limit |

| 10(13A) | HRA (for salaried tenants) | Varies by city |

❓ FAQs for First-Time Taxpayers in India

🔹 Q1. I just started working. Do I need to pay tax?

If your annual income exceeds ₹2.5 lakh (old regime), you must file ITR and may need to pay tax.

🔹 Q2. Which is better – old or new tax regime?

It depends. Choose old regime if you have investments and deductions. Use new regime if your finances are simple.

🔹 Q3. Do I need a CA to file my taxes?

No. You can file your ITR online using the Income Tax e-Filing Portal or use platforms like ClearTax or TaxBuddy.

🔹 Q4. What happens if I miss the ITR deadline?

You may have to pay a late filing fee of up to ₹5,000 and may not be able to claim your refund.

📌 Final Thoughts: Save Smart, Stay Compliant

Tax planning isn’t just for the rich. Even if you’re earning your first salary or just started a business, using the right deductions can help you legally save thousands.

Start early, keep records, and invest wisely — because saving tax is earning more without working extra hours!